Buy! Buy! Buy!

by: Jeff Quintin, on July 30, 2013 - new jersey real estate new jersey real estates nj real estate nj real estates real estate and nj real estate in new jersey real estate in nj real estate new jersey real estate nj

Hello everyone! Welcome back to Jeff Quintin TV, the most passionate real estate show on the internet!

It seems like lately interest rates have been all the buzz; everyone wants to know what’s going on with them. So, today I wanted to share with you a couple different scenarios that will show you exactly how rising interest rates will affect you now.

As you can see on the board behind me I have “Buy, Buy, Buy.” Why do I say that? We are experiencing historic low mortgage interest rates! Still! Even though they’ve gone up, they are still in the record lows! Ben Bernanke, chairman of the Federal Reserve, said interest rates will not go back down. Those rates we experienced 60 days ago or a year ago are over with.

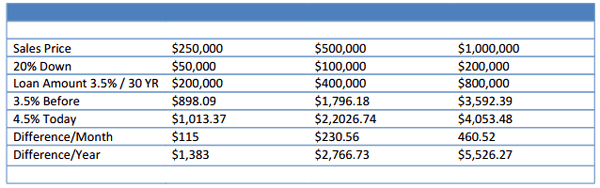

Here is my graph that is behind me in the video.

Now, let’s talk about sale prices. In our local area, we are in a ’02-’03 market. We are seeing prices the same as 10 years ago. There is not a better time to buy a home: the real estate market is coming back, inventory is shrinking, and buyer confidence is coming back. Now is the time to buy!

Let’s see how rising rates affect your monthly payment. As of May 31st, interest rates were at 3.5%. Now, they are at about 4.5%. So, if you purchased a home for $250,000 and put 20% down, that’s $50,000. If the loan amount is $200,000, the monthly payment at 3.5% is $898.09. Now, at 4.5% that monthly payment is $1,013.57. That is $115 difference a month and a around $1,300 more a year.

Here is a graph of the Three Month Trends. Click here for more mortgage trends.

In my opinion, rates will be going up again. So take advantage of them now. Let’s look at some other numbers. If you are purchasing a property at $500,000 and put a 20% down a payment of 20%, that’s $100,000. If your loan amount is $400,000 your monthly payment at 3.5% is $1,796.18, now at 4.5% your monthly payment is $2,026.00. That’s a difference of $2,700 a year. So, buying 60 days ago compared to now is a $27,000 difference over owning the property for 10 years.

The point I’m making is now is the time to buy. If you are ready to buy give us a call now and we’ll get started immediately. We’d love to help you.

Thanks for watching!